Are Fees Earned An Asset

-This question was submitted by a user and answered by a volunteer of our choice.

Pregnant of Fees Earned

Fees earned signify the revenue an entity that is generally engaged in rendering services to its clients generates during the reporting period. When an entity deals in both goods and services information technology charges fees for the role of services rendered and for the goods delivered it charges the predetermined cost. It mostly forms a major office of revenue in the service industry.

Few Instances wherein an entity record the amount earned as fees:

For Services Rendered

- Consultancy

- Consultancy on Taxation Related Matters

- Auditing and Balls

- Architectural Services

- Accountancy and Other Legal Services.

Both Goods and Services

- Manufacturing and repairs

- Trading in appurtenances and consultancy

- Goods and transport

When a combined amount is received for the cases wherein both appurtenances and services are rendered one has to record fees earned proportionately.

Whether information technology shall be Credited or Debited?

Fees Earned shall exist credited every bit fees form a part of the revenue and as per modernistic rule of accounting, the increase in an income should be "Credited".

Even if you follow the gold rule of accounting there will be no change in the answer this is because equally per the golden rule about a nominal account debit the expenses and losses and credit all incomes and gains.

Accounting treatment

If an entity follows the Cash System of Accounting entire amount received shall form part of the fees earned. One demand not distinguish fees based on actual earnings in the accounting period.

Journal Entry for the same shall be:

| Bank A/c | Debit | Debit the increase in an asset. |

| To Fees Earned A/c | Credit | Credit the increase in income. |

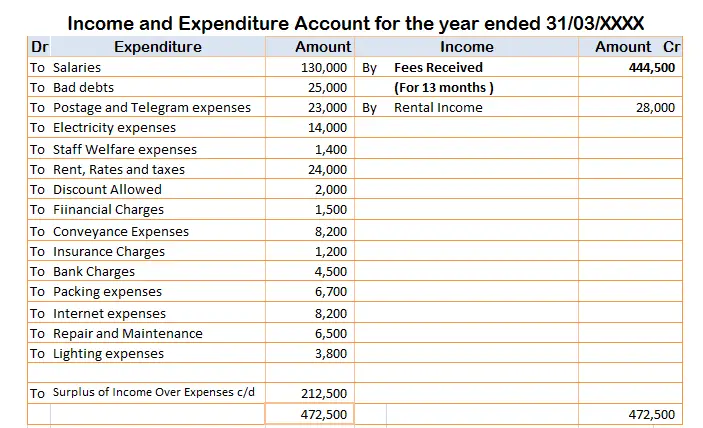

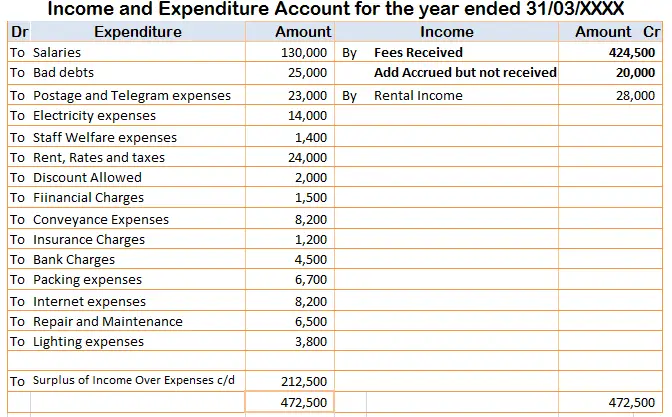

The bookkeeping treatment in an income statement is given below;

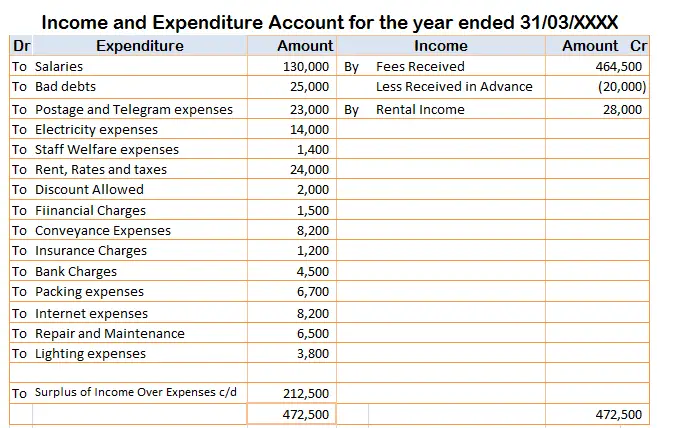

If an entity follows the Accrual Organisation of Accounting only that part of the receipts shall class a role of fees earned which has been accrued in the reporting period.

The amount if received in advance shall be recorded as a liability and if received less then such a divergence shall be recorded as sundry debtors under current assets.

Journal Entry for the same shall be;

Out of the total revenue, a function of fees is received in accelerate-

| Banking company A/c | Debit | Debit the increase in an asset. |

| To Advance Fees A/c | Credit | Credit the increase in liability. |

| To Fees Earned A/c | Credit | Credit the increase in income. |

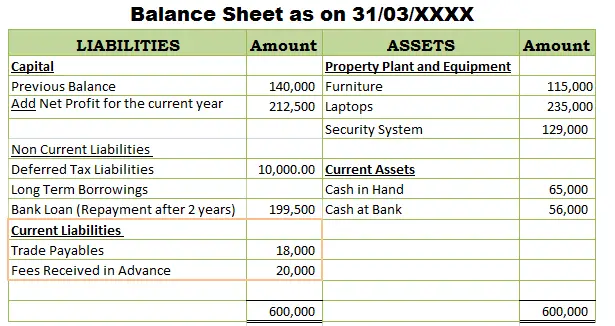

It appears in the income statement and balance canvas as;

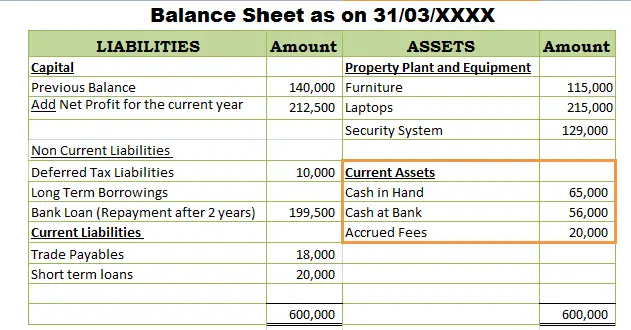

In case if merely part of fees earned is received in a reporting period:

| Bank A/c | Debit | Debit the increase in an asset. |

| Sundry Debtors A/c | Debit | Debit the increment in an nugget. |

| To Fees Earned A/c | Credit | Credit the increment in income. |

It appears in the income statement and residue sheet every bit –

As information technology can be seen in all of the cases to a higher place that fees earned beingness an income is credited.

Are Fees Earned An Asset,

Source: https://www.accountingcapital.com/question/fees-earned-debit-or-credit/

Posted by: robertsonwithatim55.blogspot.com

0 Response to "Are Fees Earned An Asset"

Post a Comment